How to Invest in Crypto Without having Obtaining Coins

The easiest way for getting expenditure exposure to crypto without the need of acquiring crypto alone is to get inventory in a firm using a monetary stake in the future of cryptocurrency or blockchain technology.

But investing in particular person stocks can bear related pitfalls as buying cryptocurrency. As opposed to deciding on and buying specific shares, industry experts suggest investors place their money in diversified index funds or ETFs in its place, with their tested file of long-phrase development in worth.

“Believe it or not, most men and women that has a retirement approach or an financial investment portfolio allocated in an index fund already have some exposure to crypto,” states Daniel Johnson, a CFP with ReFocus Monetary Organizing.

Most of the finest index resources — like S&P 500 or full industry funds — involve publicly traded organizations that have some involvement With all the marketplace by either mining crypto, staying involved with the event of blockchain technologies, or Keeping significant quantities of crypto on their equilibrium sheets, states Johnson.

Such as, Tesla — which holds in excess of a billion pounds in Bitcoin and acknowledged Bitcoin payments before — is included in any cash that keep track of the S&P five hundred. Considering the fact that its 2020 inclusion, it’s develop into Probably the most important, and as a consequence influential firms while in the index. And Coinbase, the sole publicly traded cryptocurrency exchange, is during the ARK Fintech Innovation ETF.

However, if you have some extra dollars (and you’re tolerant of the danger), it is possible to prefer to allocate a little level of your portfolio to distinct companies or even more specialized index funds or mutual funds. “An investor bullish on the way forward for cryptocurrency could spend money on the stocks of companies working on that technological innovation,” claims Jeremy Schneider, the personal finance qualified driving Personalized Finance Club.

Professionals generally advise retaining these speculative investments — whether only one business’s inventory, specialised index resources, or cryptocurrency by itself — to a lot less than 5% of the complete investing portfolio.

Purchasing Organizations with Puppies Crypto Pursuits

That’s how individual finance qualified Suze Orman in the beginning did it. She not long ago informed NextAdvisor regarding how she invested in MicroStrategy, a cloud computing agency that retains billions in Bitcoin, for the reason that its CEO was Placing all of the business’s Operating funds into Bitcoin. She figured if Bitcoin increased in value, so would the worth of Microstrategy’s inventory.

But as anyone who follows Orman’s advice understands, she endorses index cash as a much better investment approach than picking individual stocks.

As an alternative to buying shares in any solitary https://en.search.wordpress.com/?src=organic&q=Puppy Crypto crypto-forward corporation, it’s greater to take care of a well balanced portfolio by pinpointing organizations with crypto pursuits, and making sure their shares are included in any index or mutual money you put dollars into. Not only does that let you put money into the companies in which you see opportunity, but In addition, it helps you keep the investments diversified in just a broader fund.

When you spend with Vanguard, one example is, You should utilize the location’s Keeping research to locate the many Vanguard cash that come with a certain organization. Just enter the corporate’s ticker symbol (like TSLA for Tesla) and the Device will offer you a summary of many of the Vanguard items that have holdings of its shares. Other investing platforms present similar techniques to look by corporation inside of index and mutual money.

But specialised ETFs or mutual funds could also include greater fees than full market indexes, so listen to how much you’re destined to Buy Puppy Coin be charged for purchasing shares. Schneider considers an expenditure ratio (Whatever you fork out in expenses) beneath 0.2% to generally be very very low, and something about one% to be extremely highly-priced. For an previously speculative investment decision, large fees can hinder your growth much more.

Here are a few far more samples of publicly-traded firms which are including Bitcoin or blockchain know-how to their company. They're definitely not the only organizations included, and much more are becoming a member of the listing everyday. (Circle, a electronic payment platform specializing in crypto payments, for instance, just announced its supposed IPO):

MicroStrategy (MSTR)

MicroStrategy presents small business intelligence and cloud solutions, and invests its belongings into Bitcoin.

Marathon Electronic Holdings (MARA)

Marathon Digital Holdings aims for being the most important bitcoin mining Procedure in North America.

RIOT Blockchain (RIOT)

Riot Blockchain is really a Bitcoin mining organization.

Bitfarms (BITF)

Bitfarms operates blockchain computing facilities.

Galaxy Electronic (BRPHF)

Galaxy Digital is really a broker-seller involved in crypto investment management, investing, custody, and mining.

Tesla (TSLA)

Tesla’s founder Elon Musk, is often a proponent of cryptocurrency, and the business retains about a billion bucks really worth of Bitcoin. It quickly approved Bitcoin payments in early 2021 just before ending This system, but Musk recently stated Tesla will “most probably” restart Bitcoin payments.

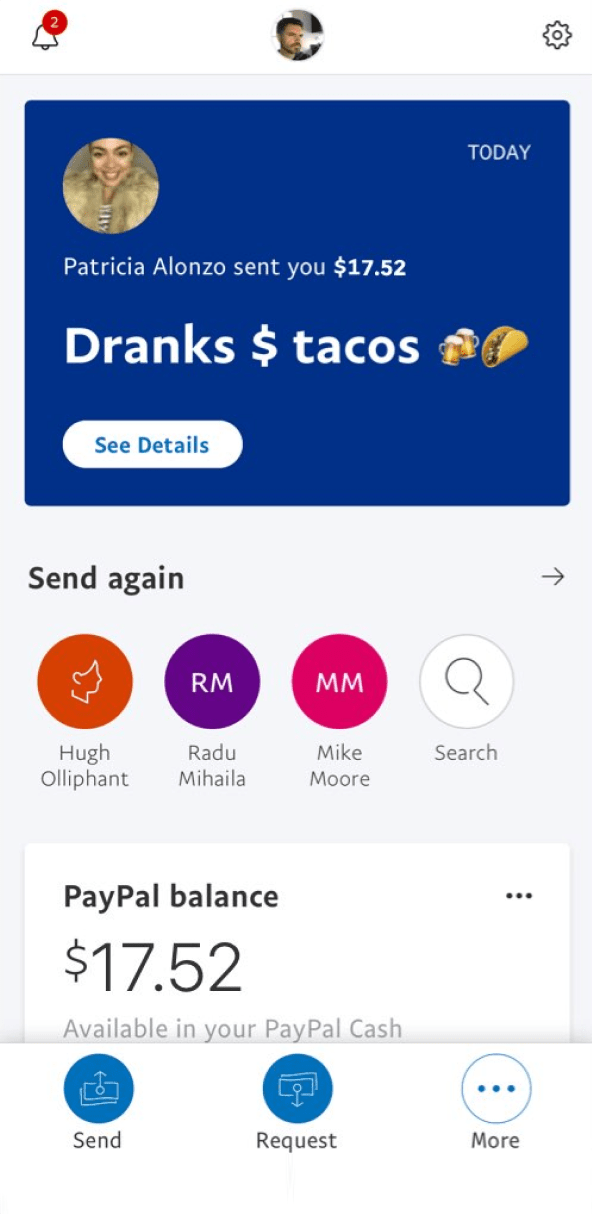

PayPal (PYPL)

PayPal is a payment System where men and women should purchase cryptocurrency.

Sq. (SQ)

Sq. not long ago introduced that It will be getting into the decentralized finance space.

Coinbase (COIN)

Coinbase is the initial community cryptocurrency Trade. It debuted about the Nasdaq in spring 2021.

Blockchain ETFs

ETFs — exchange traded funds — operate just like a hybrid between mutual funds and stocks. An ETF is basically a group of stocks, bonds or other assets. Any time you buy a share of an ETF, you've got a stake in the basket of investments owned from the fund.

While quite a few ETFs — like total marketplace ETFs — have really lower price ratios, specialized ETFs could be closer towards the one% ratio that Schneider would think about incredibly costly. This could make much less of the impression if dearer ETFs comprise a little portion of your Total portfolio, Remember the price When contemplating choices.

ETFs are often grouped by what kind of investments they hold, so A method you are able to indirectly spend money on cryptocurrency is by putting dollars into an ETF focused on its underlying know-how: blockchain. A blockchain ETF will include things like corporations possibly applying or producing blockchain technological know-how.

Several people who find themselves skeptical about cryptocurrency but believe in the “transformative” blockchain engineering driving it see blockchain ETFs as a much more seem financial investment.

It’s just like the California gold rush from the 1800s, suggests Chris Chen, CFP, of Perception Money Strategists in Newton, Massachusetts, for your recent NextAdvisor story about blockchain technological innovation: “Plenty of people rushed in there to dig for gold, and A lot of them never manufactured any revenue,” he reported. “The oldsters who created The cash Puppy token are individuals that sold the shovels. The businesses that happen to be supporting the development of blockchain tend to be the shovel sellers.”

ETFs are created by unique businesses, however , you can typically acquire them by means of whichever brokerage you usually use to speculate. Similar to you could look for your brokerage for particular person shares, You may as well seek out cash using the symbols linked to them. Here are some blockchain ETFs now available to traders (with listings on preferred brokerages like Fidelity, Vanguard, and Charles Schwab):

BLOK (Amplify Transformational Information Sharing ETF)

BLOK is the biggest blockchain ETF by overall belongings. It’s greatest holdings are PayPal, MicroStrategy, and Square.

BLCN (Siren Nasdaq NexGen Economic climate ETF)

BLCN’s top rated holdings are Coinbase, Accenture, and Sq..

LEGR (Very first Belief Indxx Modern Transaction & Process ETF)

LEGR’s major holdings are NVIDIA, Oracle, and Fujitsu.